Growing Cryptocurrency Use Cases and the Need for Crypto Wealth Management

Cryptocurrencies are a digital representation of value not issued by a central bank or another public authority and accepted as means of payment.

The easiest way to understand cryptocurrencies is to think of them as digital record books that cannot be erased or edited once a transaction is recorded. This makes them secure, decentralized and trustless which allows users to apply the technology safely without the need for oversight from a central authority like a bank or the government.

Cryptocurrencies are also secured by cryptography — an indispensable tool for protecting information in computer systems — which means they are nearly impossible to counterfeit or double-spend.

Thanks to the potential of blockchain technology that crypto is built on a vast range of use cases beyond conventional financial transactions are emerging as the number of applications for crypto and blockchain are increasing.

For example, today crypto and blockchain technology are being used for:

- • Banking the unbanked

- • Deploying a decentralized network for applications and smart contracts

- • Connecting services and resources in the Internet of Things (IoT)

- • Digitizing physical assets such as art and precious metals

- • Wealth management and more

How are Businesses Adopting Cryptocurrency?

The global adoption of cryptocurrency is facing many challenges that the industry will need to overcome before digital currency will be accepted as sound money throughout the world.

Despite this, an increasing number of companies worldwide are helping to push the industry forward by using cryptocurrencies and other digital assets for a host of investment, operational, and transactional purposes.

These companies are preparing for the future of digital money and are poised to gain from the many benefits of crypto including:

- • Ability to ensure real-time and accurate revenue-sharing while enhancing transparency to facilitate back-office reconciliation

- • Cheaper and faster transactions and receipt of funds compared to traditional banking

- • No limits or caps on how much you can withdraw from your account at one time

- • Access to new capital and liquidity pools through traditional investments that have been tokenized, as well as to new asset classes

- • An effective alternative or balancing asset to cash, which may depreciate over time due to inflation

- • Access to a broader audience including from clientele who may choose to use cryptos as their preferred payment method to gain greater transparency in their transactions

- • Ability to more easily conduct international trading and investing since cryptocurrencies are not restrained by borders like money transfers with banks

Can Cryptocurrency Transform the Future of Money?

Cryptocurrencies are quickly changing the way we live and do business. In the span of just a few years, cryptocurrencies have grown from digital novelties to trillion-dollar technologies with the potential to disrupt the global financial system.

As such, acceptance of cryptocurrencies is also growing among mega banks which are beginning to invest in the space. For example, JP Morgan recently started offering its customers six different crypto investment funds despite the bank’s initial resistance to digital assets.

In addition, the barrier to entry for financial services has been cut down thanks to stablecoins and crypto exchange platforms. Users can now earn passive income through saving and lending, providing liquidity to exchanges to facilitate crypto trading, and investing in assets like gold and other precious metals.

The ease with which people can now access crypto assets means that it is essential to have a way to manage them, similar to traditional investments in a portfolio.

Growth of Crypto Wealth Management

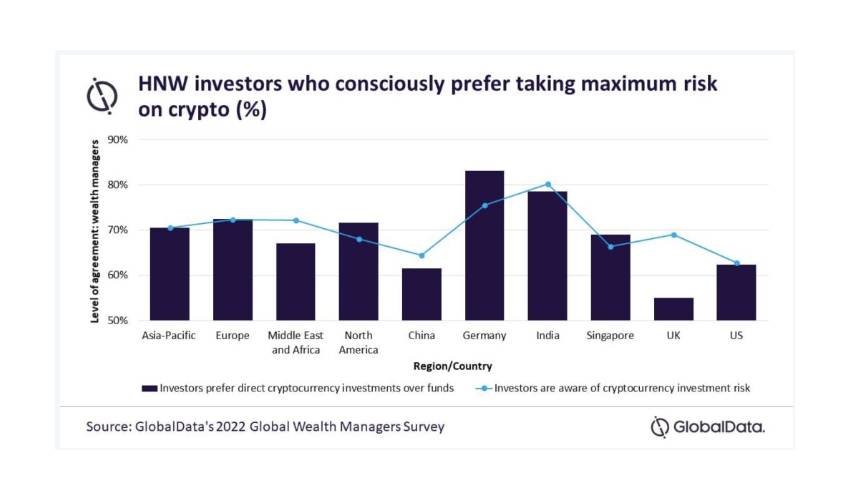

With only 16% of Americans reporting that they’ve invested in, traded or used cryptocurrency, it seems that the elevated volatility and risk in this market may be tempering trust and investment at least within the U.S.

Nevertheless, many affluent investors are going into crypto anyway. In a 2021 Trends in Investing Survey by the Journal of Financial Planning, nearly half of all advisors reported that their clients are asking about crypto, versus just 17% the prior year.

Furthermore, according to a Fidelity survey of institutional investors, high-net-worth investors (HNWIs) and financial advisors, over 50% reported that they’ve already invested in digital assets, and nearly 8 in 10 indicated that digital assets have a place in a portfolio.

According to a report from Capgemini, although the majority of HNWI have embraced cryptocurrencies and other digital assets, most have only allocated around 14% of funds into “alternative investments,” which include crypto alongside commodities, currencies, private equity and hedge funds.

“While demand is expected to grow going forward, investors are also unwilling to let cryptocurrency take up a sizable chunk of their portfolio today.” - Sergel Woldemichael, the Senior Wealth Management Analyst at GlobalData.

In light of this, crypto wealth management — the practice of purchasing and selling digital assets to be used as investments while managing a portfolio to experience an overall growth in value — is growing. In fact, the crypto wealth management market is estimated to reach more than $9 billion by 2030, indicating a CAGR growth of 30.2%.

There are several reasons investors with more than a handful of crypto assets should consider crypto asset management, including:

- • Maximizing the value of crypto investments

- • Easy and transparent monitoring of progress toward goals

- • High-quality portfolio diversification

- • Ability to better understand financial health

- • Ability to more easily invest globally, including in emerging markets

- • Ability to more easily invest in non-traditional funds

Crypto asset management can also help limit the barriers to entry when it comes to crypto- or blockchain-related investments by minimizing the complexity that comes with such investments. They can offer services like simplifying investment vehicle choices or offering investment-related education that can help investors get a better grasp of cryptocurrencies and crypto trading.

In Summary

Cryptocurrencies are digital currencies built off immutable ledger technology. They are still a somewhat controversial piece of technology, but their potential for broad application makes them attractive.

Cryptocurrencies are poised to take center stage in our lives as they lead the digital revolution in finance and business. Today, businesses, banks and investors are exploring and engaging cryptocurrency for transparent payments, wealth management and the ability to loan, lend, and save money on a computer network without central authorities.

The world of digital assets and crypto investments can be very convoluted but crypto asset management can help make this emerging market more accessible not only to investors and enthusiasts but also to the general public for everyday use and for growing personal and familial wealth.

🌍 Join Us in Making a Difference! 🌱

Do you have innovative ideas, breaking news, groundbreaking research, or expert insights that can help tackle climate change, environmental pollution, and social inequity? Share your voice with the world and be a catalyst for positive change. Together, we can create a better future! Contact us today on publishing@readyplayerinstitute.org.